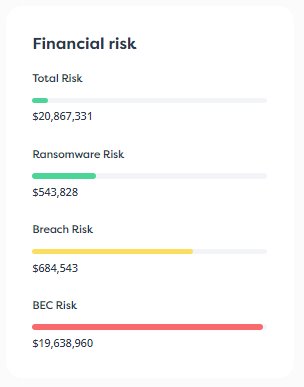

Risk management is an important part of the investors’ job. If a business they capitalize suffers significant losses due to various risks, the value of that business decreases, and the investors lose money.

Investors must consider a variety of different potential risks to organizations they are considering as targets. Before committing funds, they’ll need to account for financial, compliance, reputational, and other risks to the business.

However, in addition to the factors above, cyber risks have emerged as another major risk that investors must consider. The cyber threat landscape is evolving rapidly, and any organization can be the victim of a damaging and costly cyberattack. In fact, 52% of small and medium-sized businesses (SMB/SMEs) have suffered a cyberattack within the last year, and 10% have been the victim of more than 10 attacks.

With the average data breach costing $4.24 million, it should come as no surprise that many victims fail to recover. This poses a major risk for potential investors because a successful cyberattack can have more than a serious impact on a business’s profitability, it can completely shut down operations. An alarming 60% of SMBs close within 6 months of suffering a cyberattack.

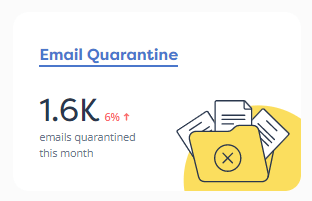

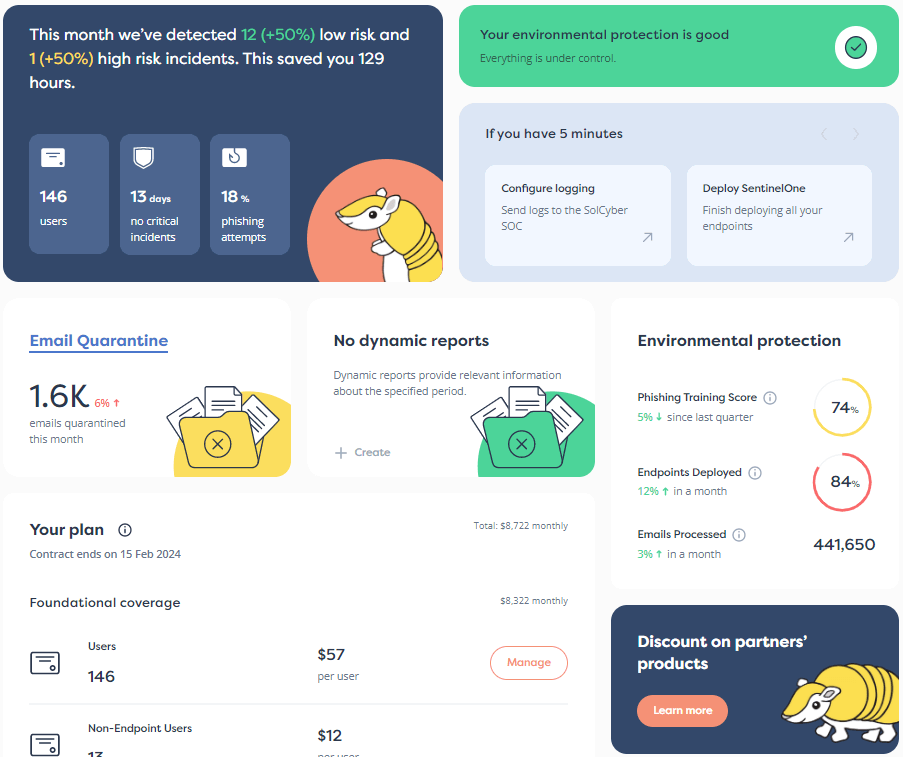

One of the biggest challenges that SMEs face when securing their systems is a lack of security visibility. Security visibility is an understanding of the systems that a company has in its IT environment. This includes the risks and vulnerabilities of their systems, the maturity of the organization’s security program, and its ability to manage cybersecurity risk and remediate quickly if something does occur.

Cyber risk is a vital risk for investors to consider. Understanding the risk posture of companies in an investor’s portfolio now and in the future requires security visibility.

Cyberattacks have become increasingly common and sophisticated. Cybercrime is a profitable business, and cybercriminals continue to refine their tools and techniques to maximize the profitability and success rate of their attacks.

As a result, any organization may be the victim of a cyberattack. Cyber threat actors may perform extensive research into potential targets, enabling them to identify the attack vectors and techniques that are most likely to be successful. They may also use automated attacks that constantly bombard companies, websites, and servers looking for a way in.

Your organization’s cyber risk also depends on the details of your business. Some factors that can contribute include:

Adequate funding for security visibility provides an investor with invaluable information about the cyber risks of potential ventures. This information can be used to better assess investment targets and understand the actual risk posed.

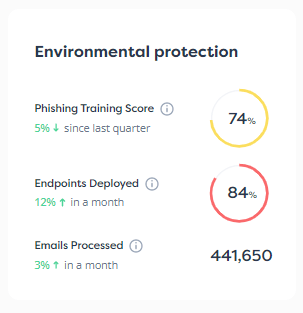

A mature security program is an ongoing process, not a goal. Just like an organization may set growth and success KPIs and benchmarks for other aspects of the business (such as sales, marketing, and churn) a company should also define benchmarks and goals for its security program.

With cyberattacks growing in volume and cost, any company in an investor’s portfolio is a potential victim of an attack. In most cases, these companies can’t afford a data breach or ransomware infection with a price tag in the millions.

That’s largely why investment in cybersecurity often provides a significant ROI in terms of risk reduction. Cyber threat actors commonly use automated attacks to identify and exploit companies lacking basic security protections. This enables them to carry out attacks at scale while devoting minimal time and effort.

Funding adequate security visibility makes it possible to identify the areas where a company is most vulnerable to exploitation. This information can highlight what expenditures a target company needs to make that would minimize corporate risk while also providing an effective means of measuring the progress and success of cybersecurity investments. For example, a company that identifies systems containing an actively exploited vulnerability can dramatically reduce its security risk by updating and patching these vulnerable systems. From there, it can acquire a process that continuously monitors and patches software and applications.

Investing in security helps to reduce an organization’s risk of expensive and damaging attacks. By doing so, a stakeholder may also increase the value of the organization for exits such as IPOs and acquisitions because he has reduced or eliminated key risks and security-related costs for the business.

Investors commonly perform due diligence regarding various parts of a business as part of their assessment and acquisition process. However, in addition to verifying the business’ contracts, finances, customers, and other factors, an investor should also consider its cyber risk.

Small and medium companies commonly underinvest in cybersecurity, focusing on their core business areas. The resulting cyber debt creates significant risk for the organization. Cybercriminals take advantage of poor security hygiene to steal sensitive data or deploy malware, both of which carry a high cost to the business.

For larger companies, the cost of implementing effective security and cleaning up cyber debt might be seen as too high. These larger companies – that are more attractive to cybercriminals due to the sensitive and valuable data they hold — are more complex and expensive to secure.

Evaluating a prospective investment’s security posture and level of cyber debt is essential before deciding to commit funds. Failing to do so may result in acquiring a company with a substantial level of cyber debt that poses significant risks and potential costs to the organization.

If an investor commits to a company with cyber debt, it is essential to create a transition plan that moves it quickly and effectively to a cyber resilient state. The confusion and distraction associated with a company that just received funding or was recently acquired makes it a prime target for cyber threat actors. If cybercriminals have done their research, they can take advantage of this, incurring significant costs for an investor.

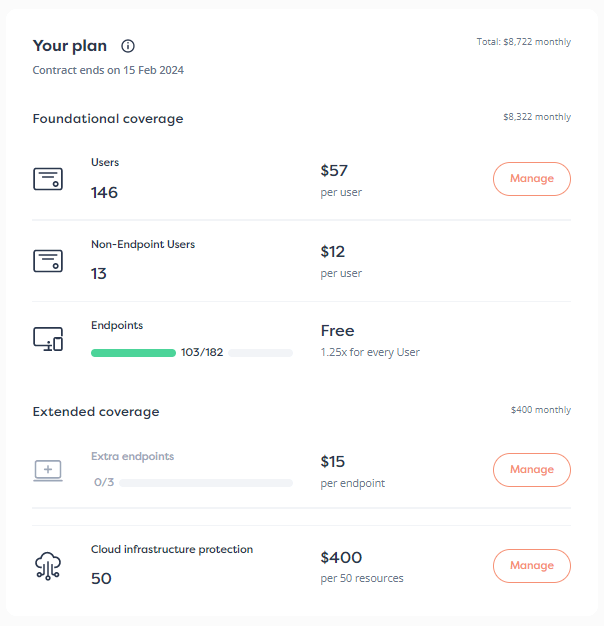

Effectively evaluating, monitoring, and managing the security of potential and current investments can require significant resources and expertise. Partnering with a modern MSSP is the best option as it can provide continuous security support for yourself as well as assessment services for potential acquisitions. Working with an MSSP lets you:

SolCyber provides cybersecurity support tailored specifically to investors’ unique needs. Learn more at our investors page.

By subscribing you agree to our Privacy Policy and provide consent to receive updates from our company.