Threat actors don’t discriminate and often leverage advanced attacks that are deployed continuously, ready to hit companies that may not have the resources, technology, or awareness to properly defend themselves. This often results in SMEs taking the brunt of these attacks.

As a result, almost half of all small businesses admit to having been victims of cyberattacks in the last twelve months. Yet, despite this increase in risk, small businesses are also less likely to purchase cyber insurance. This is largely because it’s often seen as a cost-prohibitive service, and because many SME leaders don’t have the right experience or buyer awareness to properly navigate the cyber insurance procurement environment.

While it’s a relatively new product, cyber insurance has grown to be an important form of risk management for many businesses. However, for some smaller companies, it may not be immediately clear that the price of a cyber insurance policy is worth it.

SMEs live and breathe through the lens of budgeting and cost/value analyses, filters that have to be applied to every purchase, large or small. Yet, when it comes to buying a cyber insurance policy, the answer should be very straightforward — it’s worth it!

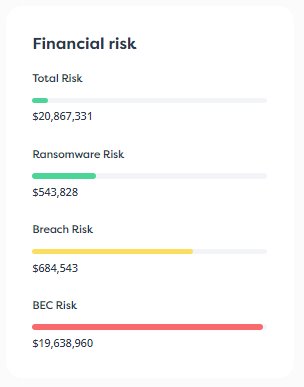

It’s no secret that data breaches are very expensive. It has been estimated that in 2021 the average cost of a data breach was $4.24 million, an all-time high. It’s a huge sum that smaller companies can’t afford to lose. Additionally, the financial toll of data breaches expands way beyond the price of simply fixing the vulnerability that caused the incident.

Some of the lesser-known costs of data breaches include the following:

Cyberattacks have grown to be increasingly numerous and more cunning. Some reports show an uptick of more than 80% in ransomware-related attacks in 2021as compared to 2020.

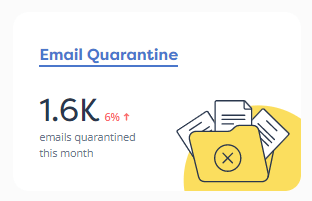

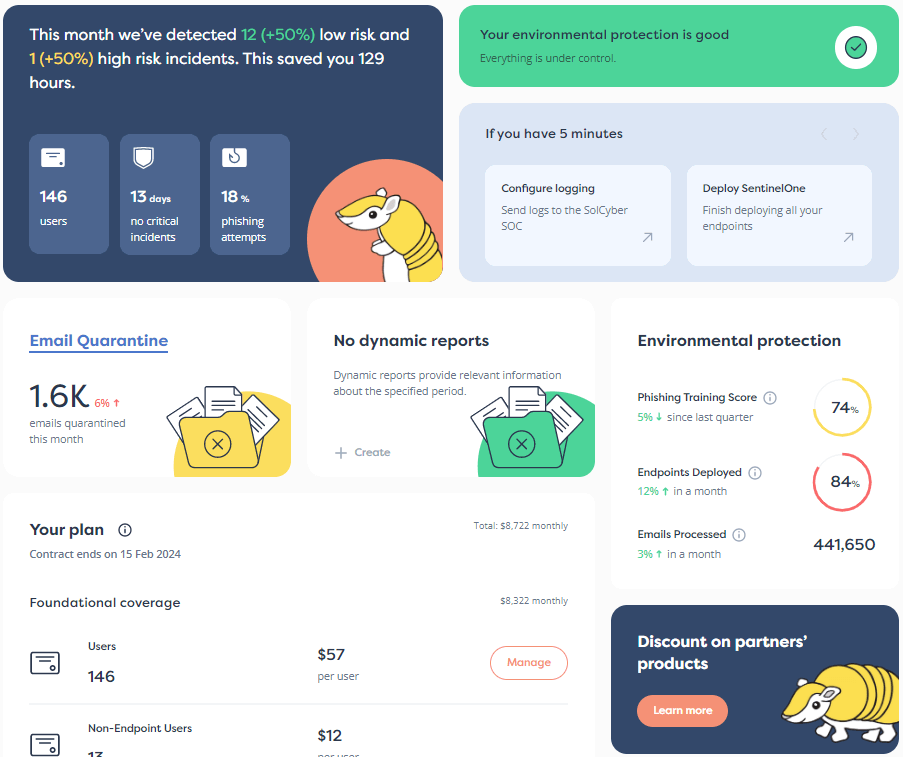

As the world grows more connected and cyberattacks continuously iterate with greater levels of sophistication, the cyber insurance market has grown more complex as well. These days, most insurance companies require organizations to be more cyber resilient before they are approved for cyber insurance. This means that cyber insurance companies expect you to be able to detect and respond to cyberattacks to minimize the chance of a data breach.

This may include implementing cybersecurity measures such as:

While this may make it harder to purchase cyber insurance, the increase in cybersecurity resilience requirements is a great opportunity to turn cyber insurance procurement into a forcing function that makes organizations more protected in the face of cyberattacks.

On top of advising what measures you need to implement; cybersecurity insurers will frequently provide great advice on how to do it. Some of them will even be happy to offset certain costs or provide cyber capabilities for free.

All of these benefits make it easier for you to get more budget from the board for your cybersecurity plans. By having your executive team agree on a cybersecurity insurance policy, you’re also getting an agreement on building up your cybersecurity defense systems – both as a preemptive measure and as a reactive set of processes and procedures.

Although some shareholders and some members of the board might be inclined to spend less on cybersecurity (and thus, on cyber insurance), the truth is that many do care.

With cyberattacks bringing businesses large and small to their knees, cybersecurity is a top priority for most boards. They want to avoid being in the position where their company is breached or compromised. Plus, having strong cybersecurity policies and procedures in place will be important when they request more funding or when the company is the target of an acquisition.

More and more VCs and PEs are including cyber risk as part of their due diligence process. They look at whether the business has been breached before and assess its overall risk management strategy. As with any negative, carrying too much cyber risk or cyber debt can degrade the valuation or even prevent the deal from going ahead. It is worth noting that a comprehensive risk management strategy involves mitigating controls (a better cyber posture) and having ways to address any residual risk (such as cyber insurance).

Small-to-medium businesses can frequently feel like outliers of the cybersecurity world. They don’t have the resources of the “big players,” but they still face the same risks and threats of attack as large enterprises. This has had the unfortunate result of many SMEs either not investing in adequate cybersecurity/cyber insurance or postponing it for “later.” If your board isn’t asking about your plans around cyber risk and cyber insurance today, then be prepared for it to come up in the near future.

Costs associated with data breaches can rapidly add up, creating turmoil for your business and possibly taking your entire team away from the main goals you’re trying to achieve. There are two ways to protect yourself, your team, and your company from having to face this kind of cost:

Those two activities are complementary, not mutually exclusive. Without doubt, investing in cybersecurity makes it more difficult for hackers to target you. However, no matter how strong your security, there’s always a chance that a data breach may occur.

This is where cybersecurity insurance comes into play. Cyber insurance financially protects your business in case of a data breach.

For those who still believe the chance of a data breach is small, it will seem that the additional expense of an insurance policy is not worthwhile. However, as we have already shown, cyberattacks are increasing exponentially, both in numbers and sophistication. Then, when one takes into account all of the potential costs associated with a data breach, it becomes very clear that the price of cyber insurance is definitely worth it.

Here are some of the costs cyber insurance would cover:

As you can see, barring specific situations, many of the costs associated with data breaches will be covered by a cyber insurance policy, alleviating the financial risk that accompanies modern cyber mischief.

No matter how you look at it, cyber insurance makes a lot of financial sense for SMEs. If you’re in doubt as to whether you need cyber insurance, consider the following:

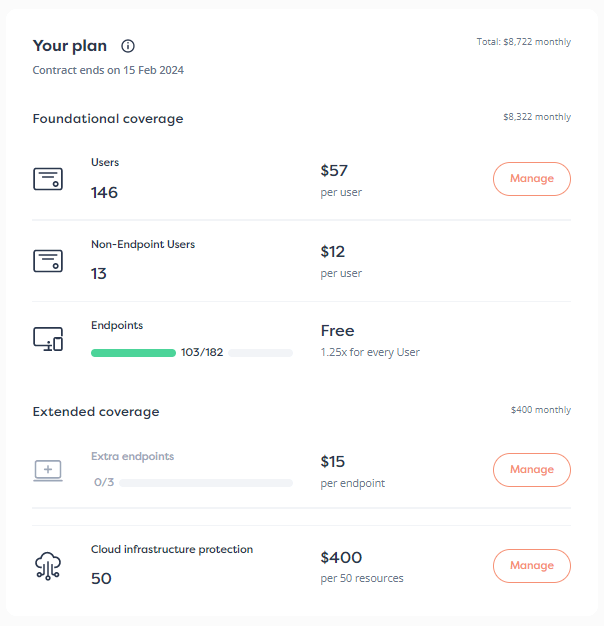

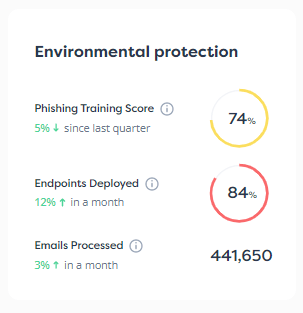

Partnering with a modern Managed Security Service Provider (MSSP) can be the best decision for smaller companies that may be strapped for resources. An MSSP can help your business reach cyber resilience making cyber insurers more inclined to approve your application. Depending on the MSSP you chose, it may already have a cyber insurance partner in place. That’s a benefit because they can guide your organization to have the specific security posture needed to purchase a cyber insurance policy. Additionally, because of the partnership between MSSP and insurer, some MSSPs (like SolCyber) even offer an insurance discount.

An MSSP can be your trusted partner. You may not have the internal resources (or the funds to hire them) – but partnering with an external company to ensure your cyber defenses are as strong as possible might be just the thing that helps you grow.

SolCyber Foundational Coverage customers have access to faster approvals and significant discounts on their cyber insurance programs, all through the SolCyber Insurance+ Program. Drop us a note and find out how.

TAKE OUR 3-MINUTE CYBER INSURANCE RISK QUIZ AND FIND OUT YOUR RISK SCORE!

By subscribing you agree to our Privacy Policy and provide consent to receive updates from our company.